If your direct deposit is failed for any reason, they will issue you a paper check to the address on record. Be sure that, at the very least, your address is current and accurate when you submit your return. This cannot be fixed by filing a tax amendment. If there is an issue, it will be mailed to you to the address submitted on your tax return. Once e-filed and accepted, the IRS will attempt to deposit the refund into the account. If you put in the wrong information for a banking account after selecting direct deposit to receive your refund, this unfortunately cannot be updated with the IRS. Additionally, this is the account that they will use to issue any future stimulus checks or Economic Impact Payments ( note: the IRS is no longer issuing stimulus payments as of December 31, 2021).

If you recently filed or e-filed a 2020 or 2021 Return and submitted inaccurate banking information - an incorrect digit, a closed account - then this is the data the IRS will use to issue your tax refund. What happens when I submit the wrong bank information on my tax return? View the latest e-file and direct deposit statistics. It is more accurate, safer, and you get your refund faster! Next time, e-File your taxes and sign up for direct deposit.

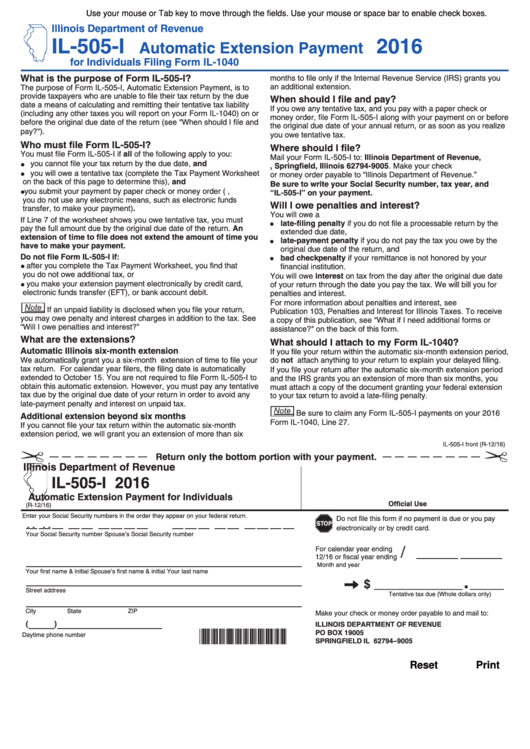

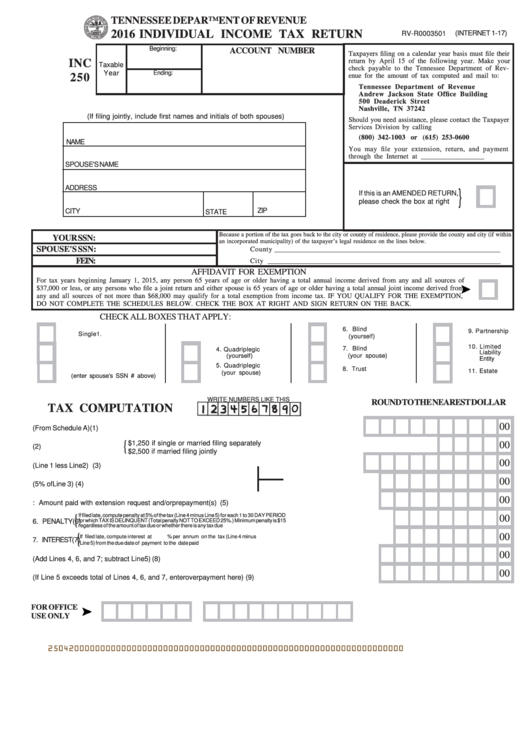

Tax year 2016 extension form update#

Call 1-80 to verify your mailing address or your bank account.If your refund check was returned to the IRS, you might be able to change your address online via the IRS website.The most common reason for a missing refund is a failed direct deposit if the deposit fails, the IRS will attempt to issue you a check. If you are missing a refund, follow the steps below and read the examples for specific information that may pertain to your situation.

Tax year 2016 extension form how to#

How to Claim a Missing Tax Refund Payment What if you moved or changed bank accounts since you filed your tax return and the IRS does not have your new mailing address or new bank account number? Read on to learn how to update this information. Bounced Refund Bank Deposit, Returned Refund ChecksĮach year, there are billions of dollars of refund checks that are undelivered due to incorrect mailing addresses or wrong bank account numbers. In addition, learn how to claim the refund you deserve! See options to receive your tax refund.

0 kommentar(er)

0 kommentar(er)